Frequently Asked

Questions

- Ang bawat miyembro na ang edad ay hindi lagpas ng 65 ay covered sa life insurance na nagkakahalaga na P100,000. Kung ang miyembro ay namatay, ang kanyang beneficiary(ies) ay makakakuha ng P100,000.

- Mayroong burial benefit na may halaga na P10,000 o 10% ng halaga ng life insurance. Karagdagan ito sa P100,000 life insurance benefit.

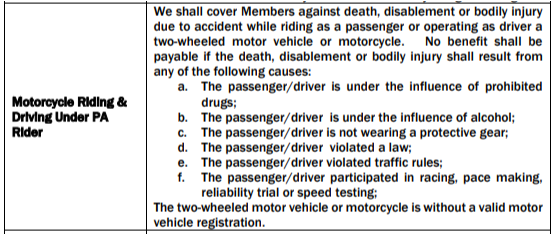

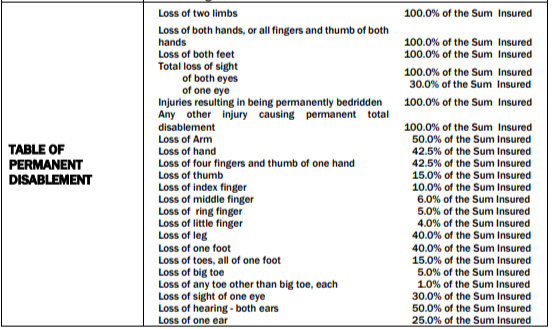

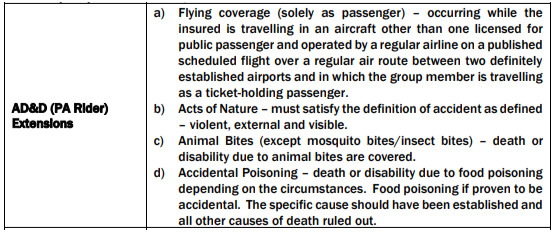

- Accidental Death and Dismemberment o Personal Accident rider (details in the next section)

- Terminal illness benefit

Pwedeng i-advance ang kalahati ng life insurance benefit sa halagang P50,000, kung ang miyembro ay:- Na diagnosed na may terminal illness na certified ng doctor na accepted ng AXA;

- May life expectancy na isang taon o mababa sa isang taon. Hindi na makakakuha ng terminal illness benefit ang mga na-diagnose na may terminal illness bago mag January 1, 2023, ang effective date ng benepisyong ito.

- Nag-submit ng katibayan ng kanyang terminal illness at naaprubahan ng AXA.

- Ang namatay na miyembro ay dapat active member ng UPPF. Hindi eligible ang namatay na miyembro na:

- nauna nang nag-withdraw ng membership;

- nag-resign sa UP;

- inactive member o miyembrong walang kaltas sa sweldo para sa Member’s Contribution ng higit sa anim na buwan;

- Charter member o empleyado ng UP mula December 1, 1993 hanggang December 31, 1995 subalit hindi nagpa-miyembro sa UPPF.

- Ang isang retired member ay eligible pa rin sa life insurance benefit kung siya ay compulsory retired at namatay within the year of retirement. Halimbawa, kung si Member A ay compulsory retired as of January 15, 2023 at hindi na miyembro ng Provident Fund at namatay noong January 31, 2023, eligible pa rin ang kanyang beneficiaries sa life insurance benefits dahil ang date of death ay within the year of retirement. Pero kung ang date of death ay January 1, 2024, hindi na eligible ang beneficiaries dahil ang date of death ay hindi na within the year of retirement.

- Kung ang miyembro ay lagpas sixty-five (65) years old ang edad, ang halaga ng kanyang insurance benefit ay 50% na lamang. Ito ang reduction formula policy na pinaiiral ng AXA Philippines, ang kasalukuyang insurance provider ng UPPF. Sa oras na umabot ng 70 years old ang miyembro, awtomatikong hindi na siya covered ng insurance, kahit pa siya ay miyembro ng UP Provident Fund. Mananatili lamang na covered ng 50% insurance benefit ang mga more than sixty-five (65) years old kung sila ay miyembro pa ng UP Provident Fund.

Ang mga miyembro na may edad na 66 years old pataas ay hindi na kasama sa coverage ng Accidental Death and Dismemberment o Personal Accident rider.

Oo, covered ito sa ilalim ng AD & D (PA rider).

Application Process

Ihanda ang requirements.

- Death Claim Form (Claimant Statement) – duly accomplished and signed by the claimants

- Death Claim Form (Attending Physician Statement) – duly accomplished and signed by the Attending Physician.

- Death Certificate of the Deceased (NSO/PSA copy) – duly certified and bears the proof of registration from Local Civil Registry. (If death happened abroad, the certificate must had originated from the country of death)

- Birth Certificate of the insured & beneficiary/ies must be registered with Local Civil Registrar or NSO/PSA

- Valid ID of the Claimant(s) – present the actual ID(s) and submit photocopy(ies)

- Present at least one Primary ID as shown below

- SSS ID

- GSIS ID

- Driver’s License

- Passport

- Voter’s ID, or

- Any Government ID (with photo & signature)

- Present at least one Primary ID as shown below

- Complete Medical records – to include copy of actual admitting history, discharge summary and all laboratory or work up results. (in-patient or out- patient consultation from clinics or hospitals

- Bank Deposit Authorization and Proof of Bank Account

Additional Requirements for Accident, Murder, Homicide or Suicide

- Police Report (if none, submit Affidavit of at least (2) persons cognizant to circumstances surrounding the violent death)

- Autopsy Report

Ihanda ang requirements.

- Death Claim Form (Claimant Statement) – duly accomplished and signed by the claimants

- Death Claim Form (Attending Physician Statement) – duly accomplished and signed by the Attending Physician.

- Death Certificate of the Deceased (NSO/PSA copy) – duly certified and bears the proof of registration from Local Civil Registry. (If death happened abroad, the certificate must had originated from the country of death)

- Birth Certificate of the insured & beneficiary/ies must be registered with Local Civil Registrar or NSO/PSA

- Valid ID of the Claimant(s) – present the actual ID(s) and submit photocopy(ies)

- Present at least one Primary ID as shown below

- SSS ID

- GSIS ID

- Driver’s License

- Passport

- Voter’s ID, or

- Any Government ID (with photo & signature)

- Present at least one Primary ID as shown below

- Complete Medical records – to include copy of actual admitting history, discharge summary and all laboratory or work up results. (in-patient or out- patient consultation from clinics or hospitals

- Bank Deposit Authorization and Proof of Bank Account

Additional Requirements for Accident, Murder, Homicide or Suicide

- Police Report (if none, submit Affidavit of at least (2) persons cognizant to circumstances surrounding the violent death)

- Autopsy Report

I-submit ang required documents.

I-submit ang requirements sa aming opisina o ipadala ang mga ito gamit ang email. Bisitahin ang “Contact Us” page para malaman ang lokasyon ng opisinang malapit sa inyo o ang email address ng cluster office kung saan dapat ipadala ang inyong mga dokumento. Siguraduhin na ang mga dokumento ay malinaw at nababasa.

Ang mga requirements ay susuriin ng Account Officer kung ito ay kumpleto, malinaw, at tama. Kung may pagkukulang, i-iinform ng Account Officer ang beneficiary/ies na ikumpleto ang mga dokumento .

I-submit ang required documents.

I-submit ang requirements sa aming opisina o ipadala ang mga ito gamit ang email. Bisitahin ang “Contact Us” page para malaman ang lokasyon ng opisinang malapit sa inyo o ang email address ng cluster office kung saan dapat ipadala ang inyong mga dokumento. Siguraduhin na ang mga dokumento ay malinaw at nababasa.

Ang mga requirements ay susuriin ng Account Officer kung ito ay kumpleto, malinaw, at tama. Kung may pagkukulang, i-iinform ng Account Officer ang beneficiary/ies na ikumpleto ang mga dokumento .

Hintayin ang deposit/fund transfer sa inyong bank account.

Kadalasang inaabot ang AXA ng (4) weeks para i-process at i-release ang insurance claim. Ang proceeds ng life insurance ay matatanggap bilang deposit/fund transfer sa bank account ng beneficiary/ies.

Forms

Critical Illness Claim Form (Claimant’s Statement)

Disability Claim Form

Critical Illness form Form (Physician)

Death Claim Form

Death Claim Form (Physician)